Hourly to salary calculator with overtime

Taxes Paid Filed - 100 Guarantee. Since the employee makes 10 an hour the employee should be paid 400 for the 40 hours worked and 150 for the extra 10 hours worked.

Hourly To Salary What Is My Annual Income

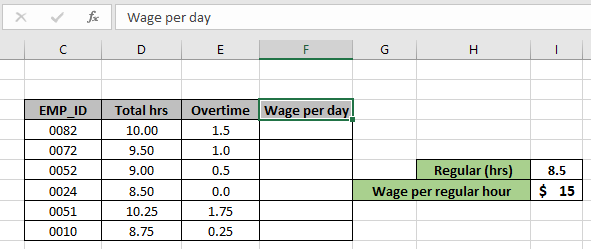

For instance in case the hourly rate is 1000 and someone works 4 extra hours over the standard time of 8 hours a day his daily wage will be.

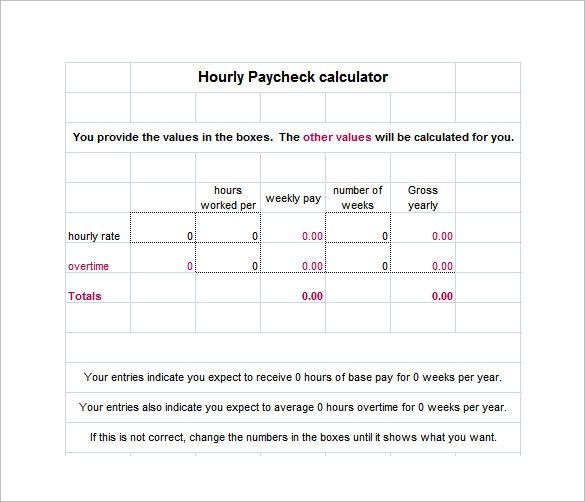

. Note this is binded to the Regular period. Enter the number of hours and the rate at which you will get paid. Calculate overtime pay for a monthly-rated employee.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Overtime 1 - This is the hour when overtime begins to be paid. Overtime Weekly Pay Hourly Wage x 15 x Overtime Hours.

Including the one-half times overtime. In the Weekly hours field enter the number of hours you do each week excluding any overtime. Use the following formulas to calculate salary from hourly wage.

If you do any overtime enter the number of hours you do each month and the rate you get paid. Choose Your Paycheck Tools from the Premier Resource for Businesses. - standard hourly pay rate 20 - overtime hours worked 30 - overtime pay rate 30 - double time hours 5 - double time pay rate 40 and a one time bonus of 100 will result in these.

Easy To Run Payroll Get Set Up Running in Minutes. This online Salary to Hourly Pay Calculator will translate your weekly monthly or annual salary into its per minute hourly. Regular Weekly Pay Hourly Wage x Hours Worked.

Overtime Hours The amount of hours worked above-and-beyond 40 hours. Find out the benefit of that overtime. Ad Get the Paycheck Tools your competitors are already using - Start Now.

Taxes Paid Filed - 100 Guarantee. Therefore they will be equal to each other. Salary to Hourly Pay Calculator with Lost-Overtime-Wage Feature.

For example for 5 hours a month at time and a half enter 5 15. We use the most recent and accurate information. Overtime 2 - This is the hour when the.

Create professional looking paystubs. Overtime Weekly Pay Hourly Wage x 15 x Overtime. Overtime Pay Rate OTR Regular Hourly Pay Rate.

Hourly pay Monthly salary 12 Hours worked per week Weeks per year. Ad In a few easy steps you can create your own paystubs and have them sent to your email. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week.

There are two options. The final figure will be your hourly wage. The overtime calculator uses the following formulae.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10. 1000 8 8000.

Lets say you earn 2500 per month and work 40 hours each. Regular Weekly Pay Hourly Wage x Hours Worked.

How To Calculate Overtime Pay From For Salary Employees Youtube

Calculate Overtime Amount Using Excel Formula

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

Overtime Calculator

Overtime Pay Calculators

Overtime Calculator Workest

Real Hourly Wage Calculator To Calculate Work Hour Net Profit

Salary To Hourly Salary Converter Salary Hour Calculators

4 Ways To Calculate Annual Salary Wikihow

3 Ways To Calculate Your Hourly Rate Wikihow

Overtime Pay Calculators

Hourly To Salary Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Overtime Pay Calculators

Hourly To Salary Calculator Convert Your Wages Indeed Com

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates