Unsecured loan payment calculator

Unsecured personal loan. How does my credit.

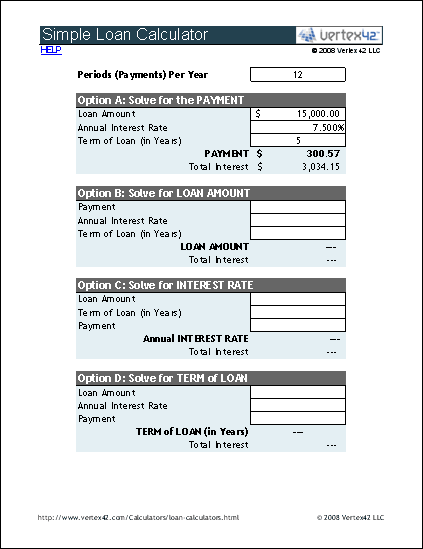

Simple Interest Loan Calculator How It Works

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

. The default interest rate. So if you earn 3000 a month after taxes your all-in car costsincluding auto loan payment gas maintenance and repairs and car insurance should come out to no more than 450 per month. Fixed payments paid periodically until loan maturity.

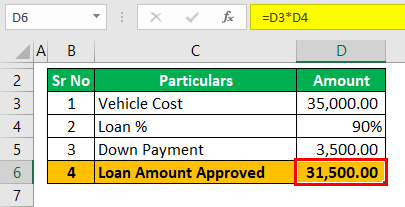

The car loan calculator does not consider fees. When you take out a student loan you not only agree to. Just be aware.

Most loans can be categorized into one of three categories. Business loans can also be secured though unsecured ones can be hadAn equipment loan for instance is a type of secured business loan. Tata Capital Unsecured Business Loans offer you customised loans to suit your business plan.

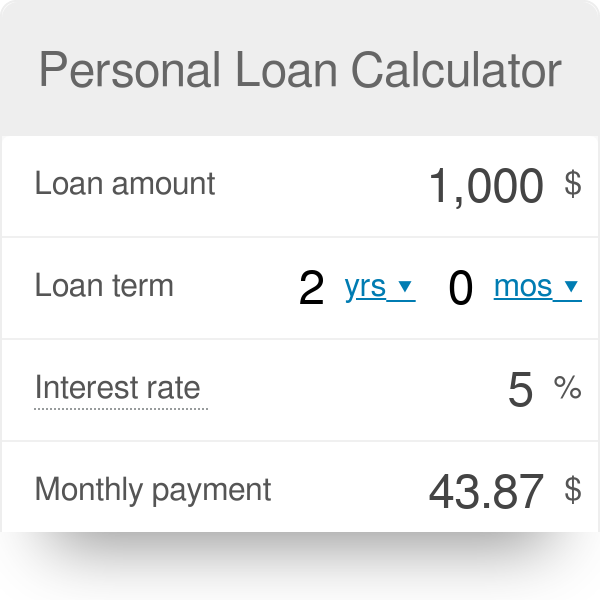

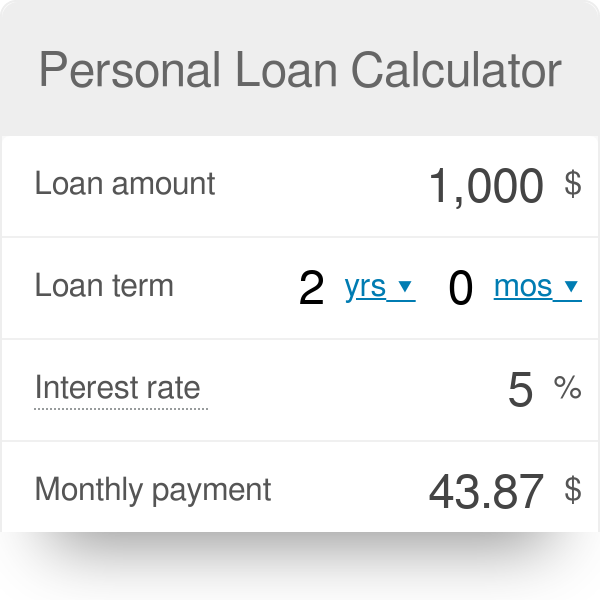

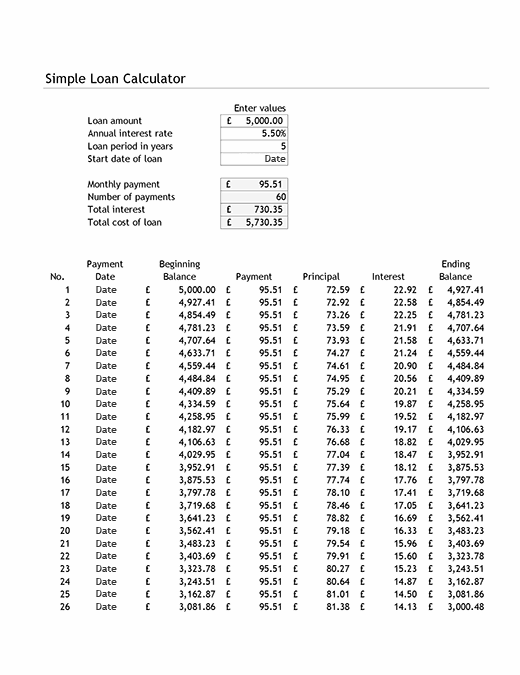

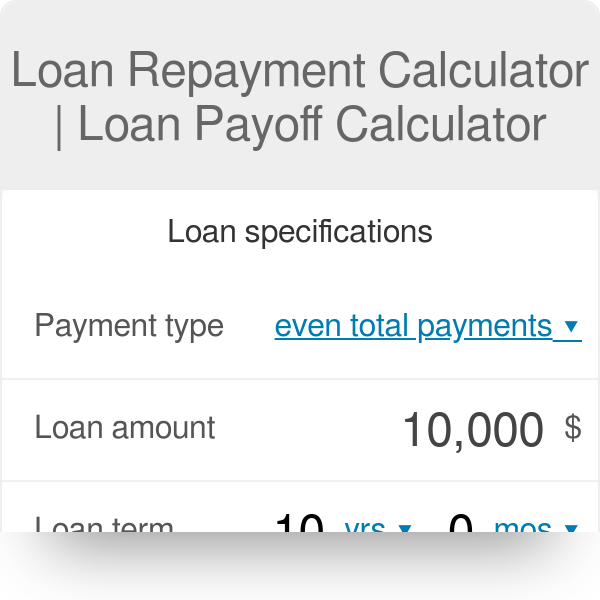

For example if you have an auto loan with a monthly payment of 500 your first months payment might break down into 350 toward interest and 150 toward the principal. This loan calculator will help you determine your monthly payments for different types of loans. Depending on the calculator you can find out the monthly payment amount that is required to pay your credit card balance in full or it can provide you with your estimated purchases and the.

Depending on the calculator you can find out the monthly payment amount that is required to pay your credit card balance in full or it can provide you with your estimated purchases and the. Buy new machinery increase working capital or outperform your competitors. Business Loans.

Use the pool loan calculator shown above to calculate your monthly payment. Second mortgages come in two main forms home equity loans and home equity lines of credit. Put together different types of debts with multiple lenders by consolidating them debts into one loan and one monthly payment.

5 year auto loan with good credit. Most car loans on Canstars database 88 charge an application fee. Full usage instructions are in the tips tab below.

Calculate EMI using Travel Loan Calculator. Use our free personal loan calculator to discover how much you could afford to borrow and what your monthly repayments might be. If you default on payments for an unsecured loan the lender is not able to automatically take possession of.

As a car loan is typically secured against the vehicle and secured loans generally come with lower interest rates. J10000 NCB Sunshine Savers. Student loans are also a type of unsecured loan although they tend to have hallmarks more commonly associated with secured loans.

J5000 NCB Gold Club age 55 and over J5000 NCB Chequing Account. A debt consolidation loan is a popular means of merging multiple debts owed on several unsecured accounts into one loan with one monthly loan payment. If you are thinking of updating your home you may be interested to know that there are home improvement loan calculators online to help a homeowner determine what the estimated monthly payments will be for a particular loan amount.

Second mortgage types Lump sum. A car loan calculator and a personal loan calculator are very similar apart from one key feature. A personal loan is an unsecured lump-sum loan that is repaid at a fixed rate over a specific period of time.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Say you own a construction business and. Well charge 12 each time a loan payment is late.

Learn more about borrowing. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future. Here are some of the different types of loan.

Check our personal loan prepayment calculator and find out the prepayment amount required for personal loan. A home improvement loan calculator can help you budget your project and determine potential loan payments. It is a flexible loan because it can be used to consolidate debt pay off higher.

An unsecured loan is a loan that is issued and supported only by the borrowers creditworthiness rather than by any type of collateral. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. The average fee is 272 based on a 10000 secured loan at the time of writing.

Loan applicants new to Bajaj Finserv can apply for a personal loan by filling up a simple application form online. This is because the average interest rate for both car loans and personal loans is different. Debt Consolidation Loan Calculator.

Find out what youll be paying monthly for a new car or truck. We offer unsecured personal loans. As you can see the difference between the cost of borrowing the loan with a 763 and 1188 APR is significant.

A credit card payment calculator is just one tool that may prove to be useful when you want to find out just how long it could take to pay off your debt. Find out your monthly payment and the date your loan will be fully paid off. Read any of the topics below.

The personal loan calculator will give you an approximate guide to what someone with a particular credit rating will get. Existing Bajaj Finserv customers can avail of unsecured loans without applying for a personal loan. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan.

A credit card payment calculator is just one tool that may prove to be useful when you want to find out just how long it could take to pay off your debt. A part pre-payment calculator works on the following factors. An unsecured loan is one that is obtained.

You can also calculate what your monthly payments might be by using our loan payment calculator. Youd save 35839 in interest over the life of your loan by opting for the 763 rate over the 1188 rate and your monthly payment would be about 10 cheaper. Because of the length of terms for a HELOC anywhere from 10 30 years the monthly payments are the most manageable.

This means that if we decide to lend you money it wont be secured on your home car or other assets. You can also use the calculator on top to estimate extra payments you make once a year. Rates locked in for duration of loan.

Ready to Borrow Better. J100 NCB START up to 17 years of age J5000 NCB Regular Save. The loan amount Tenor in months Rate of interest Pre-payment amount Once you enter these details the calculator tells you how much money you will save on EMIs after the part-prepayment.

30-Year Fixed Mortgage Principal Loan Amount. If you have availed of a product from Bajaj Finserv before you can check your pre-approved offer and get the money you need.

Loan Calculator Wolfram Alpha

Personal Loan Calculator Student Loan Hero

Free Interest Only Loan Calculator For Excel

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Excel Formula Calculate Payment For A Loan Exceljet

Simple Loan Calculator

Loan Calculator That Creates Date Accurate Payment Schedules

Personal Loan Calculator

Simple Loan Calculator And Amortisation Table

Loan Calculator That Creates Date Accurate Payment Schedules

Loan Calculator Free Simple Loan Calculator For Excel

Loan Calculator How To Calculate Periodical Installments

Loan Calculator Credit Karma

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Personal Loan Calculator See Your Payments On A Loan Credible

Loan Repayment Calculator

Advanced Loan Calculator